Warburton Capital Management

“What Are the Keys to A Good Investment Experience”?

So, a buddy sends me an email. It develops that this particular buddy is a respected financial services industry veteran who always makes a lot of sense. In this particular email my buddy was addressing a useful topic = “What Are the Keys to A Good Investment Experience”?

My buddy opened up with “In most endeavors, there are things we can control and things we can’t. That’s true in life. That’s true in business. That’s true with investing.”. Well said!

The good news about investing is that the market rate of return has rewarded investors over the long term. Over the short term – as anyone who has paid attention to markets knows – markets go up and markets go down. Let’s explore a few observations about the investment business and what it takes to have A Good Investment Experience.

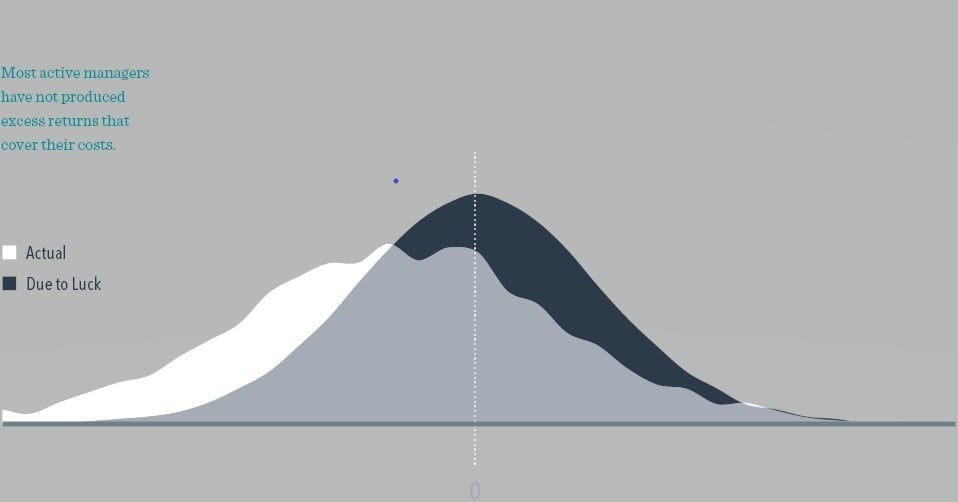

To begin, let’s examine – as investors – the “Things We Can’t Control”, specifically, the random performance of traditional money managers. Few things have been studied as extensively as the performance of mutual funds that are professionally managed by traditional money managers – stock pickers. While the results indicate that some managers have good track records, there are far fewer of them than you would expect by sheer chance. What does that mean to investors? It means that after analyzing all the historical data, we can’t seem to separate skilled money managers from lucky ones. Now, if we can’t identify superior managers after the fact, how can we hope to identify them in advance? The evidence seems to indicate, there is no magic possessed by professional/traditional stock picking money managers.

Consider the exhibit on the next page which reveals the relative performance of mutual funds from the statistical perspective of “Is Their Performance Attributable to Luck or Skill”:

The Distribution of Luck vs. Skill in US Equity Mutual Fund Performance

3,870 US Equity actively managed mutual funds, 1984—2015

With the central axis defined as the Market Rate of Return, the preceding exhibit demonstrates that the actual performance of the majority of traditional money managers is inferior to the performance we would expect by random chance. (By random chance we would expect half of the managers to ‘beat the market’ and half of the managers to ‘underperform the market’.) Executive Summary = The performance of traditional money managers has, as a group, under-performed the market rate of return. Our Takeaway = One of the Things We Can’t Control seems to be picking a winning mutual fund.

Continuing our exploration of “Things We Can’t Control”, let’s talk about ‘Uncertainty’. Throughout our lives, we must continually deal with uncertainty and make choices – what school to attend, what career to pursue, where to live and so forth. We make these decisions without knowing the outcomes. We look at all the possibilities and then we decide. Much of the financial services industry is geared toward making people think they can eliminate uncertainty in investing. However, the future is unknowable. The evidence suggests the best approach to dealing with uncertainty is to make informed choices, adjust as your needs and objectives change and be comfortable with the range of possible outcomes.

Consider the exhibit on the next page which reveals the performance of traditional/professional money managers relative to the Market Rate Of Return:

Industry Mutual Fund Performance

US mutual funds over 15-year period ending December 31, 2017

The preceding exhibit reveals that about one out of seven traditional money managers have out-performed the market rate of return as defined by their relative benchmarks over a statistically significant period of time. Executive Summary = Given the low odds of a traditional money manager ‘beating the market’, the evidence suggests investors should avoid ‘stock pickers’! Our Takeaway = We believe investors are best served by utilizing a methodology with an enhanced probability of delivering the market rate of return!

OK, now that we’ve examined a couple of “Things We Can’t Control”, how about we turn our attention to a more positive topic = the “Things We Can Control”!

Step One – Developing an investment philosophy we can stick with.

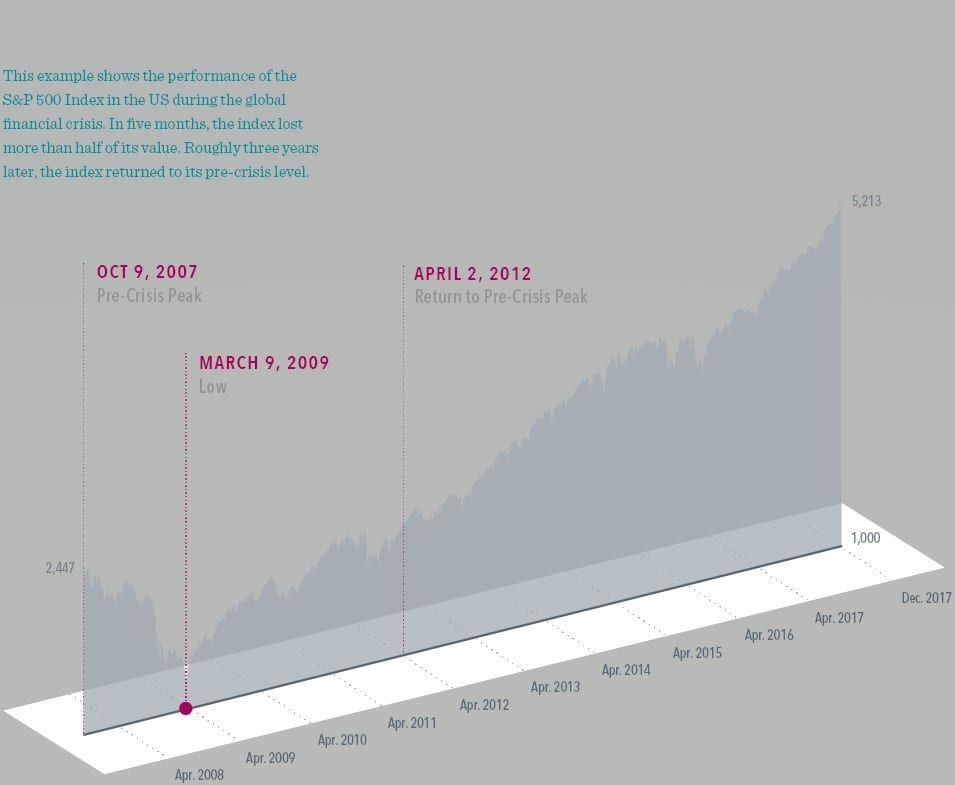

A philosophy serves as a compass to guide us through turbulent times. When we’ve got a compass, it doesn’t take drastic directional changes to find our way. Small adjustments are all we need to stay on course. In 2009, the US stock market was down more than 50%, which seems to happen about once every generation. A lot of people were stressed out by the uncertainty, so they cashed out and stayed out. That locked in their losses. The market, as it turned out, rebounded astoundingly and some of those people who got out of the market may have to wait decades to get back to where they were. It’s unfortunate they didn’t have a philosophy such that they could have weathered the storm.

Consider the exhibit on the next page which reveals the performance of the S&P 500 Index from a few months before the ‘financial crisis’ through late 2017:

Weathering the Storm

The preceding exhibit reveals that those investors who had a philosophy which enabled them to ‘Weather The Storm’ ended up more than doubling their money in the ten-year period beginning 10/9/2007 thru 10/9/2017. Executive Summary = Market Timing is seductive, however, the evidence seems to indicate that having a Philosophy is a better idea. Our Takeaway = We believe investors are best served by having an evidence-based philosophy, trusting it and being patient!

Trusting an evidence-based strategy and being patient is no easy task.

Trust involves many different parts. To trust markets, we must understand how they work, which means having a source of reliable knowledge. The best source is scientific research, not opinions and hunches. We must also trust the professionals who are managing our investments, which involves a clear understanding of what services and expertise we are paying for, how much we are paying in fees/costs and a set of realistic expectations for future outcomes. Most people lack the specific knowledge required to perform their own brain surgery, draft their own estate plans or manage their own investment portfolio.

A trusted financial advisor can help us figure out our goals, values, needs, resources and obligations. A trusted financial advisor can also present different ways of forming portfolios and ensure that we understand the possible distribution of outcomes. Through a consultative process, we can make informed choices about how to invest knowing our advisor then keeps watch over what is happening and together we revise our investment plan if needed.

Executive Summary: Investing is a dynamic process and a lifelong journey. A “Good Investment Experience” is more likely if we have a philosophy we can stick with – fully understanding the range of possible outcomes – and adjust along the way purposefully.

We believe these are the keys to a better investment experience. Stay disciplined, control what we can control and keep a long-term view on our destination so we can focus on what really matters and enjoy our lives. As regards my buddies’ email…I really enjoyed it and hope you find my recap to be interesting and useful.

Always wishing you the very best as you sort through the myriad of investment solutions being pitched at you by the financial services industry and, mostly, wishing you a relationship with a fee only fiduciary financial advisor who coordinates the many facets of your wealth management while creating for you a uniquely purposeful plan utilizing evidence-based instruments, I remain

Warburton Capital Management