So, a buddy walks in. The Markets have rebounded from the Pandemic meltdown in March and our buddy is wondering if this would be a good time to ‘go to cash and wait for a pullback to reinvest.’

Ah-ha… The allure of Market Timing has its claws in her.

Granted, successful Market Timing would be the Holy Grail for returns…only if it could be done.

Critics of Market Timing contend that it is nearly impossible to time the Market successfully compared to staying fully invested over the same period.

The difficulty of Market Timing lies in the challenge of making two successful decisions (when to sell and when to buy) over and over again.

At Warburton Capital we are opposed to Market Timing. Instead, we favor a Purposeful Dedication of Assets to Fixed Income to fund spending over the next 10-15 years with any surplus of liquidity being invested in stocks. We are comforted by the belief that the Markets will advance handsomely over the next 10-15 years as they, generally, have historically.

That said, we are not only opposed to Market Timing (i.e., playing a guessing game) by bouncing between stocks and bonds, we are also opposed to Market Timing in an effort to predict when small cap or large cap will be in favor; when value stocks or growth stocks will be in favor; or when highly profitable companies or less profitable companies will be in favor. Our view is supported by evidence.

Let’s take a look at some evidence:

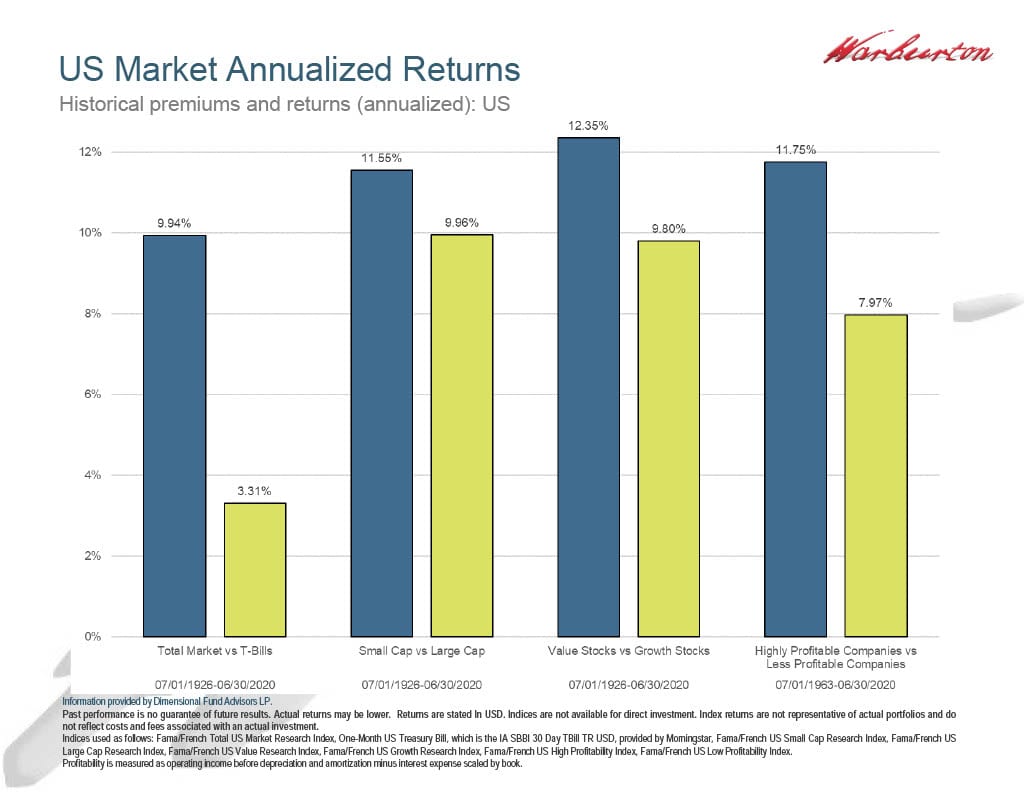

The graphic below illustrates the fact that over the history of available data:

- Stocks have outperformed bonds by 6.63% annually

- Small cap stocks have outperformed large cap stocks by 1.59% annually

- Value stocks have outperformed growth stocks by 2.55% annually

- Highly profitable companies have outperformed less profitable companies by 3.78% annually

So, if you want to have the house odds on your side and you have dedicated sufficient assets to bonds, we recommend over-weighting the stocks that you own to small cap, value stocks and highly profitable companies.

Then comes the question: Will this always work?

Let’s take a look at some more evidence:

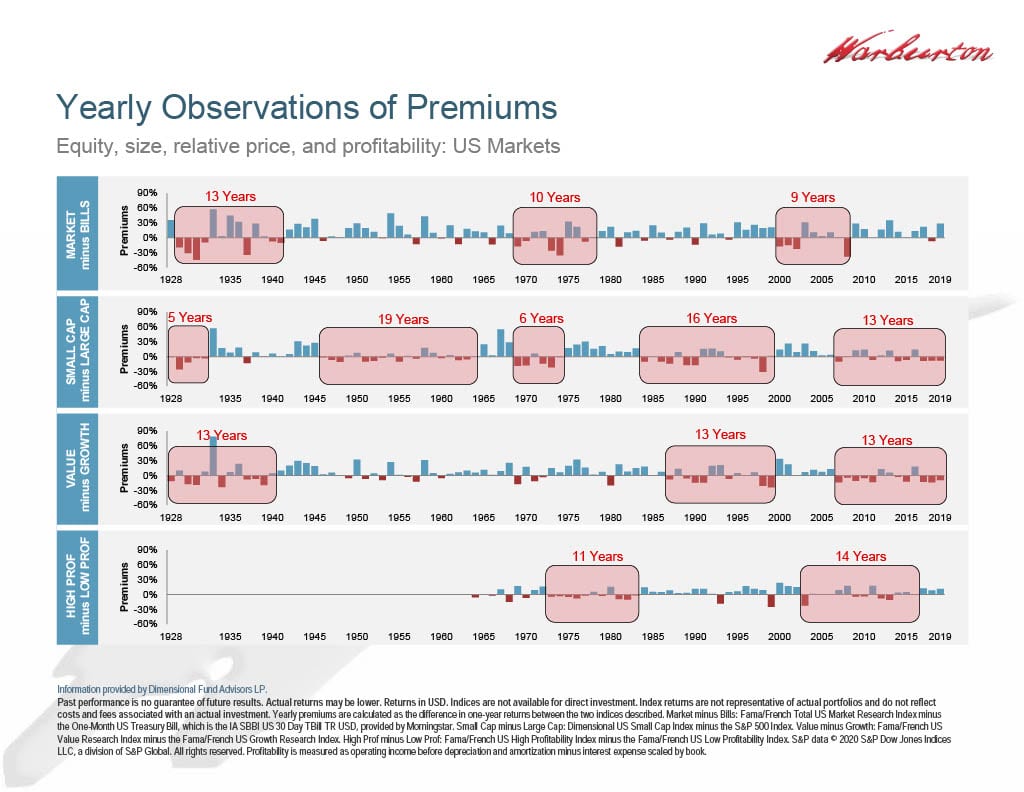

The somewhat startling evidence provided by the two previous images indicates that:

- Yes. We can reasonably expect long-term outperformance by investing in stocks vs bonds, small stocks vs large stocks, value stocks vs growth stocks, and highly profitable companies vs less profitable companies.

- However, we cannot reasonably expect outperformance each and every year.

This information is especially relevant – and maybe a little disappointing – to investors who over-weighted small cap and value stocks over the past decade as large cap and growth stocks have posted terrific returns.

- Do we expect this diversion to continue? No!

- Is it possible that it will? Yes!

So, our buddy took a look at the evidence we provided and came away with about the same conclusions that we at Warburton Capital have:

- Forecasting is futile.

- There are many unknowns in the Marketplace.

- Markets can zig and zag in opposition to our expectations for extended periods of time.

- When making investments, we are on very thin ice if we are looking for immediate gratification.

- The unexpected has a reasonable chance of occurring with frequency and for extended periods of time.

At this point our buddy threw her hands up in the air and said “I get it. I want to invest with statistical evidence on my side, confident that I have made an intelligent decision, and in full knowledge that I may or may not be correct.”

Thereafter we constructed a Purposeful Goal Achieving Portfolio for our buddy with sufficient assets dedicated to future spending and the surplus liquidity invested in stocks.

Trusting you are living your life well, maintaining social distance, and not worrying about your portfolio because you have a Purposeful Plan in place, I remain

Yours Truly,

On Behalf of the Firm,

Tom Warburton