Using the science of finance, Warburton Capital advisors create long-term investing strategies based on measured and purposeful research. We partner with Dimensional Fund Advisors to provide scientific, sound investment planning for our clients. This includes helping clients understand that market fluctuations, understood through a historical lens, are expected and factored into a smart yield projection.

Dimensional Fund Advisors’ investing models are built to stand the test of time, and are built upon:

Drawing from Dimensional Fund Advisors resources for investors, we’re able to identify and guide clients through a purposeful investing process for long-term success.

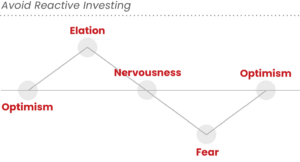

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions.

A financial advisor can offer expertise and guidance to help you focus on actions that add value. This can lead to a better investment experience.

- Create an investment plan to fit your needs and risk tolerance.

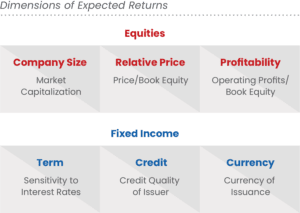

- Structure a portfolio along the dimensions of expected returns.

- Diversify globally.

- Manage expenses, turnover, and taxes.

- Stay disciplined through market dips and swings.

Source: Dimensional Fund Advisors

Past performance is no guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. This information is for illustrative purposes only. See back page for additional exhibit information and important disclosures.

Exhibit 1: In USO. Source: Dimensional Fund Advisors, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. ETFs and funds are excluded. Daily averages were computed by calculating the trading volume of each stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as an approximate number of annual trading days.

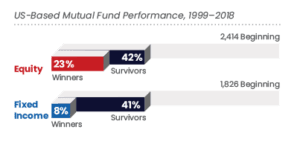

Exhibit 2: The sample includes funds at the beginning of the 20-year period ending December 31, 2018. Each fund is evaluated relative to its respective primary prospectus benchmark as of the end of the evaluation period. Surviving funds are those with return observations for every month of the sample period. Winner funds are those that survived and whose cumulative net return over the period exceeded that of their respective primary prospectus benchmark. Loser funds are funds that did not survive the period or whose cumulative net return did not exceed that of their respective primary prospectus benchmark. Where the full series of primary prospectus benchmark returns is unavailable, funds are instead evaluated relative to the Morningstar category index assigned to the fund’s category at the start of the evaluation period.

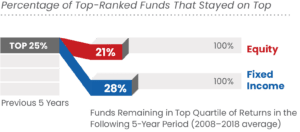

Exhibit 3: This study evaluated fund performance persistence over rolling periods from 1999 through 2018. Each year, funds are sorted within their category based on their previous five-year total return. Those ranked in the top quartile (25%) of returns are evaluated over the following five-year period. The chart shows the average percentage of top-ranked equity and fixed income funds that kept their top ranking in the subsequent period.

Source (Exhibits 2 and 3): US-domiciled open-end mutual fund data is from Morningstar. Equity fund sample includes the Morningstar historical categories: Diversified Emerging Markets, Europe Stock, Foreign Large Blend, Foreign Large Growth, Foreign Large Value, Foreign Small/Mid Blend, Foreign Small/Mid Growth, Foreign Small/Mid Value, Global Real Estate, Japan Stock, Large Blend, Large Growth, Large Value, Mid-Cap Blend, Mid-Cap Growth, Mid-Cap Value, Miscellaneous Region, Pacific/Asia ex-Japan Stock, Real Estate, Small Blend, Small Growth, Small Value, World Large Stock, and World Small/Mid Stock. Fixed income fund sample includes the Morningstar historical categories: Corporate Bond, High Yield Bond, Inflation-Protected Bond, Intermediate Government, Intermediate-Term Bond, Long Government, Muni California Intermediate, Muni California Long, Muni Massachusetts, Muni Minnesota, Muni National Intermediate, Muni National Long, Muni National Short, Muni New Jersey, Muni New York Intermediate, Muni New York Long, Muni Ohio, Muni Pennsylvania, Muni Single State Intermediate, Muni Single State Long, Muni Single State Short, Short Government, Short-Term Bond, Ultrashort Bond, and World Bond. See Dimensional Fund Advisors’ Mutual Fund Landscape 2019 for more detail. Index data provided by Bloomberg Barclays, MSCI, Russell, FTSE Fixed Income LLC, and S&P Dow Jones Indices LLC. Bloomberg Barclays data provided by Bloomberg. MSCI data© MSCI 2019, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. FTSE fixed income indices© 2019 FTSE Fixed Income LLC. All rights reserved. S&P data© 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

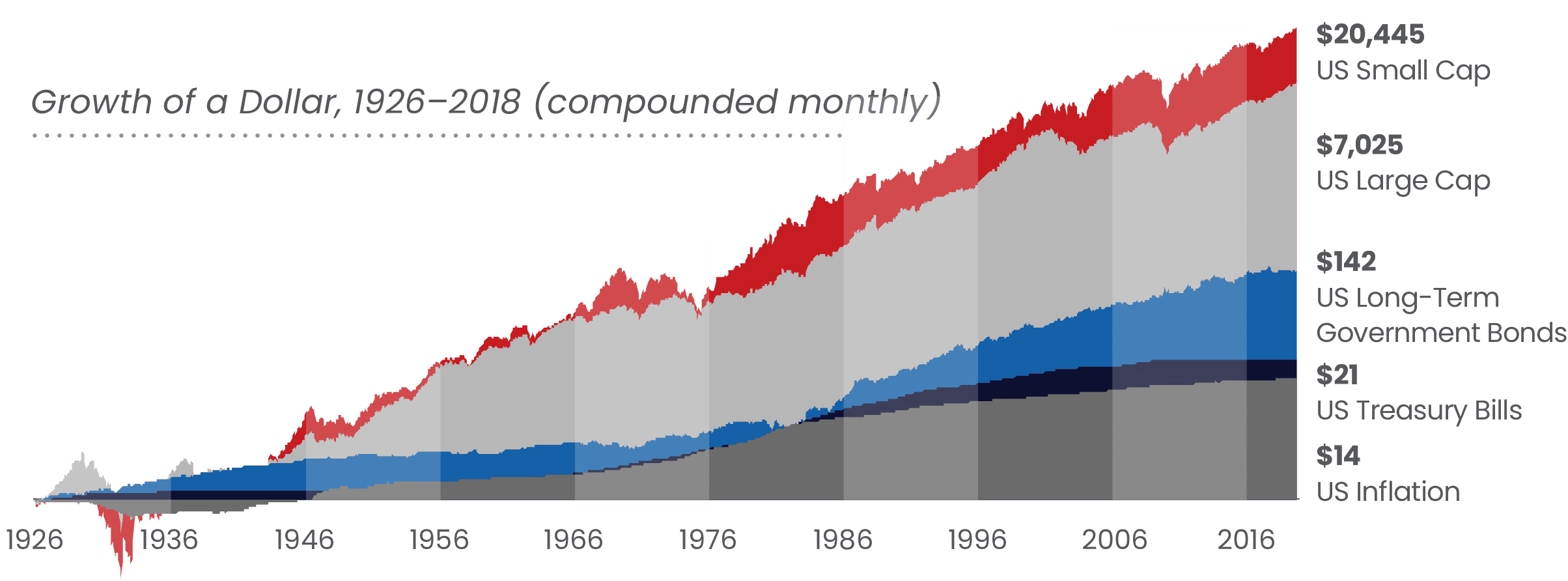

Exhibit 4: In USO. US Small Cap is the CRSP 6-10 Index. US Large Cap is the S&P 500 Index. Long-Term Government Bonds

is the IA SBBI US LT Govt TR USO. Treasury Bills is the IA SBBI US 30 Day TBill TR USO. US Inflation is measured as changes

in the US Consumer Price Index. CRSP data is provided by the Center for Research in Security Prices, University of Chicago.

S&P data© 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Long-term government bonds and Treasury bills data provided by Ibbotson Associates via Morningstar Direct. US Consumer Price Index data is provided by the US Department of Labor Bureau of Labor Statistics.

Exhibit 5: Relative price is measured by the price-to-book ratio; value stocks are those with lower price-to-book ratios. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book.

Exhibit 6: Number of holdings and countries for the S&P 500 Index and MSCI ACWI (All Country World Index) lnvestable Markel Index (IMI) as of December 31, 2018. S&P data© 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. MSCI data© MSCI 2019, all rights reserved. International investing involves special risks, such as currency fluctuation and political instability. Investing in emerging markets may accentuate these risks.

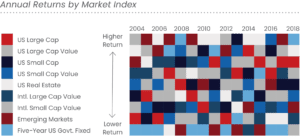

Exhibit 7: In USO. US Large Cap is the S&P 500 Index. US Large Cap Value is the Russell 1000 Value Index. US Small Cap is the Russell 2000 Index. US Small Cap Value is the Russell 2000 Value Index. US Real Estate is the Dow Jones US Select REIT Index. International Large Cap Value is the MSCI World ex USA Value Index (gross dividends). International Small Cap Value is the MSCI World ex USA Small Cap Value Index (gross dividends). Emerging Markets is the MSCI Emerging Markets Index (gross dividends). Five-Year US Government Fixed is the Bloomberg Barclays US TIPS Index 1-5 Years. S&P and Dow Jones data© 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data© MSCI 2019, all rights reserved. Bloomberg Barclays data provided by Bloomberg. Chart is for illustrative purposes only.