So…a buddy comes in and, given the coin toss between discussing the direction of Stock Prices or the looming increase of Interest Rates, we settled on Interest Rates. Terrific!

Calendar year 2015 was clearly, “The Year the Talking Heads Forecasted an Imminent Rise In Short Term Interest Rates and Speculated Bond Holders Would Get Destroyed”. It develops that Short-Term Rates Did Rise. Congratulations speculators…Well Done! Yet – Bond Holders Didn’t Get Destroyed! Woops…I guess the speculators missed this one. (Guessing right half the time is what we expect with speculations!)

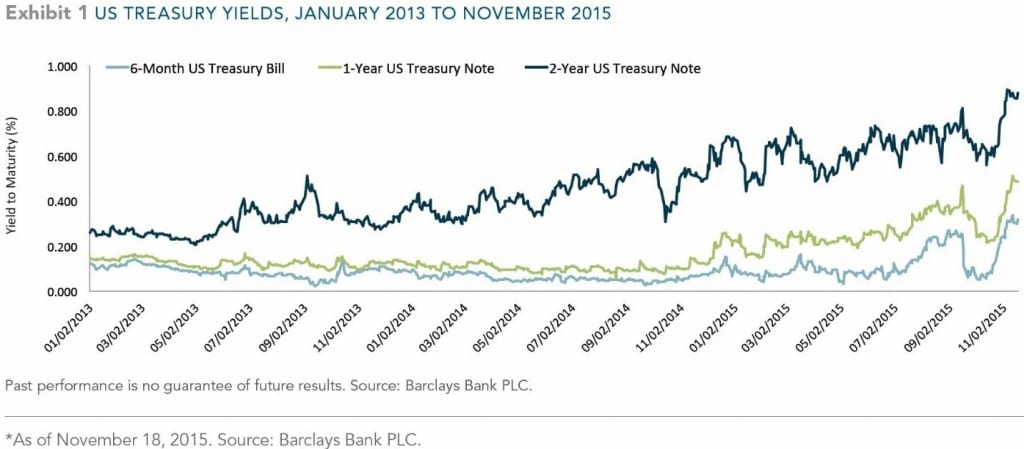

As evidence that rates increased I offer the following “Exhibit 1” which illustrates almost three years of yield curve data for 6-Month US Treasury Bills, 1-Year US Treasury Notes and 2-Year US Treasury Notes. In the past 52 weeks the yields on 6-Month US Treasuries increased almost five-fold from 0.11% to 0.50%, yields on 1-Year US Treasuries increased more than double from 0.25% to 0.66% and yields on 2-Year US Treasuries almost doubled from 0.69% to 1.07%.1

As evidence that not all Bond Holders were destroyed, I offer the following evidence:

- In Calendar Year 2015 the Total Return (Total Return = Interest Received +/- Security Price Changes) of Dimensional’s Five-Year Global Fixed Income Portfolio (DFGBX) was 1.45%.2

Now, 1.45% really isn’t anything to write home about, but it seems to be a return substantially in excess of cash sitting in a Money Market Account. Further, given whom you believe as to “What the Current Rate of Inflation Is”, a 1.45% return seems to have maintained purchasing power. Not Bad…The Bonds Returned More Than Cash And Kept Up With Inflation!

It is worth repeating that “Despite The Higher Rates, We Have Not Experienced The Conjectured Financial Storm In The Fixed Income Markets”!

The yearlong commiserating throughout 2015 of when and how much the Fed would raise interest rates was answered in December when the Fed raised the discount rate by 0.25%. The questions of when and how much the Fed will raise the discount rate in the future remains a mystery…the future is always a mystery.

The questions I find more interesting are:

- If (or ‘when’ if you prefer) the Fed raises overnight rates in the future…will it be a ‘ho hum’ event or will it set off the much and frequently conjectured financial storm?

- Whereas market participants, through buying and selling, ‘re-priced’ yields on US treasury paper in 2015 before the Fed actually raised the discount rate, I wonder – Did The Market Lead The Fed Or Did The Fed Impact The Market By Setting Expectations?

Neither I nor anybody else KNOWS with certainty the answer to these questions.

I do believe that folks liquidating their investments to fund their lifestyle should have ten to fifteen years of Net Currency Need invested in Short-Term Investment-Grade Globally Diversified Fixed Income. I don’t expect the return on these securities to be anything to write home about. History, however, does inform us that we can expect the return on these securities to exceed, over the long haul, the return of cash in a money market account and maintain purchasing power by keeping up with inflation while offering daily liquidity and reasonable volatility. (No Guarantees Here…Just My Humble Observations.)

Trusting this will find you – and my buddy who wanted to talk about interest rates – enjoying the New Year and being Purposeful with your Wealth Management Planning, I remain

Yours truly,

Warburton Capital Management

1 Treasury Yields Data Updated 1/6/2016 From https://www.bankrate.com/rates/interest-rates/treasury/

2 Dimensional Fund Data Updated 1/6/2016 From https://my.dimensional.com/fundcenter/performance/