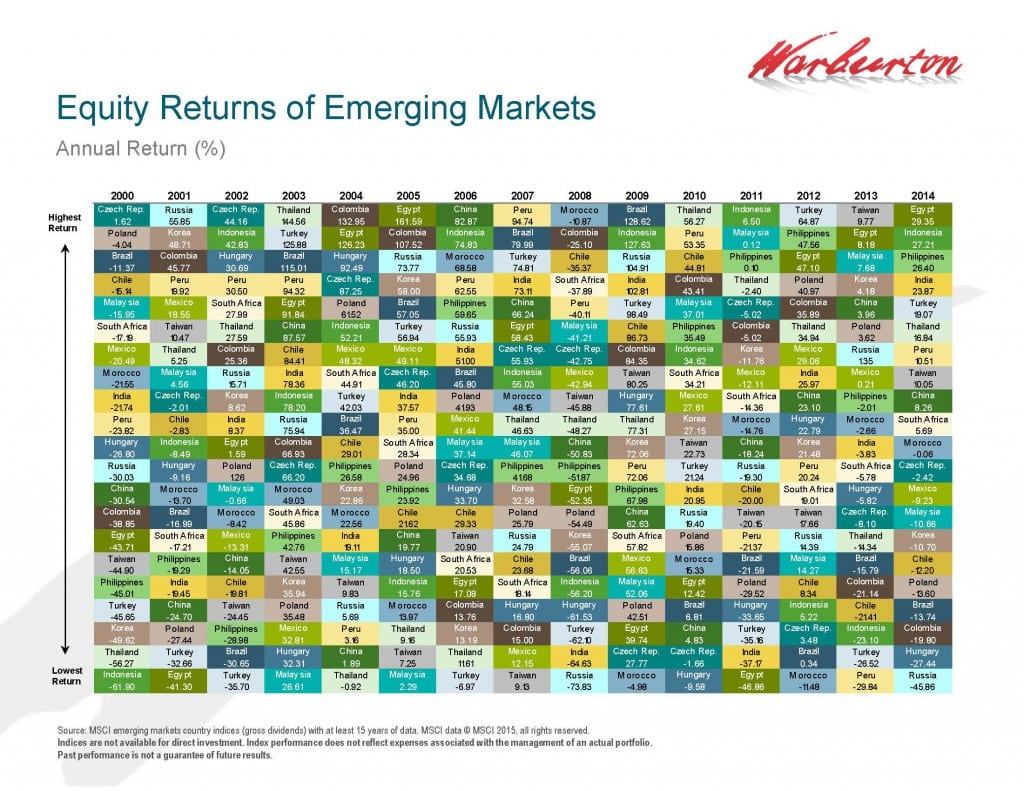

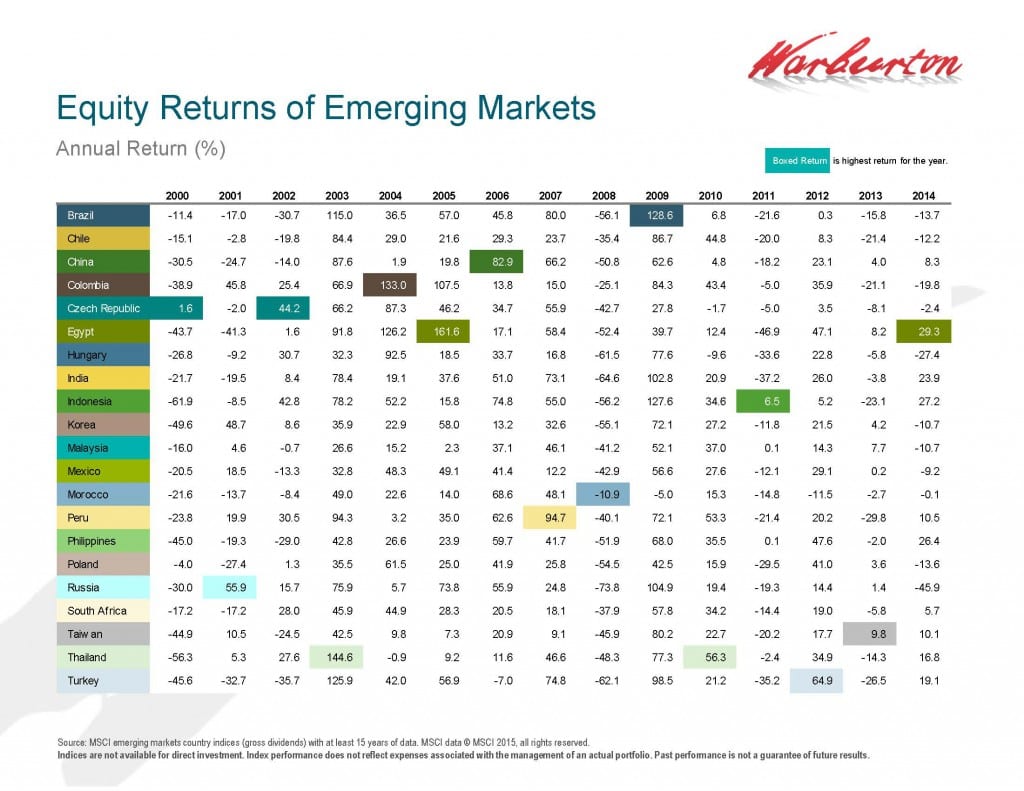

This month, we are expanding our look at US versus Foreign Performance by examining the Non-Developed Markets – commonly referred to as the Emerging Markets or BRIC’s – Brazil, Russia, India, China and nineteen or so others…depending on whose definition you believe.

While it is curious that the US Markets dominated Developed Markets by returning 12.69% in 2014, it is useful to note that US Market dominance did NOT outperform all markets around the world in 2014. (In 2014 the markets in Egypt, Indonesia, The Philippines, India, Turkey and Thailand all produced returns superior to those of the US that ranged from 29.35% to 16.84%.)

We believe investors interests are best served by Focusing On What Can Be Controlled:

• Create An Investment Plan/Allocation That Solves For Unique Needs And Risk Tolerance

• Structure A Portfolio Utilizing The Dimensions Of Expected Returns

• Diversify Broadly And Globally (US, Developed and Non-Developed)

• Reduce Expenses

• Minimize Taxes

Of course, adherence to a purposefully derived goal based Investment Plan is difficult as the daily market news and commentary challenges one’s discipline. (Buy Gold…Tech funds On The Rise…Dow Dives 500 points….Gold Market Busts…Housing Market Booming…The Five Best Funds…etc.) Some messages stir anxiety about the future while others tempt us to chase the latest investment fad. My advice when resolve is tested:

• Focus On Objective Academic Evidence And Maintain A Long-Term Perspective.

Placing our faith in a Well-Reasoned, Long-Term, Evidence-Based Plan, we remain

Yours truly,

Warburton Capital Management

Keep Scrolling for a Graphical Representation of Emerging Markets Data

Click image to see a full-screen version.

Click image to see a full-screen version.